There are no family relationships among the executive officers or directors of the Company. There are no arrangements or understandings pursuant to which any of these persons were elected as an executive officer or director.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH OF THE DIRECTOR NOMINEES.

Directors’ MeetingsBOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Board is actively involved in assessing and Committeesmanaging risks that could affect the Company. Part of the Board's role is to periodically assess the processes utilized by management with respect to risk assessment and risk management, including identification by management of the primary risks of the Company’s business, and the implementation by management of appropriate systems to deal with such risks. The Board fulfills these responsibilities either directly, through delegation to committees of the Board, or, as appropriate, through delegation to individual directors. When the Board determines to delegate any risk management oversight responsibilities, typically such delegation is made to the standing committees of the Board.

Mr. Goldstein serves as both the Chairman of the Board and the Chief Executive Officer of the Company. The Company believes this is appropriate in light of Mr. Goldstein’s significant experience and leadership roles with the Company, and his in-depth knowledge of consumer products and the Company’s management, marketplace, customers, marketing, sales and strategic vision.

The Company has four executive officers. They are Mr. Goldstein, Mr. Hinkle, Mr. Passantino and Brian L. Boberick. Information regarding Mr. Goldstein and Mr. Hinkle is stated above under “Nominees.” Information concerning Mr. Passantino and Mr. Boberick is as follows:

Mr. Passantino, 55, has been employed by the Company since 1981. He has been Vice President – Operations of the Company since November 2002 and Corporate Secretary from 2002 until 2011. From 1991 to 2002, he served as Operations Manager of the Company.

Mr. Boberick, 55, a certified public accountant, has been the Chief Financial Officer and Treasurer of the Company since his election to these positions by the Board on February 24, 2009. Mr. Boberick was formerly Controller/Credit Manager of the Company since October 2000. While Controller/Credit Manager, he was involved in, among other things, the daily operations of the finance department, preparation of annual and quarterly reports to the SEC, and the Company’s relationships with lenders and others. Prior to joining the Company, Mr. Boberick was a controller at a sports marketing company, held finance positions at two other companies and was a senior auditor at an accounting firm.

The officers of the Company are elected annually at the first meeting of the Company’s Board held after each annual meeting of shareholders and serve at the pleasure of the Board.

DIRECTORS’ MEETINGS AND COMMITTEES

During the year ended December 31, 2007,2010, the Company had five directorsfour Board meetings plus fivetwo actions by unanimous written consent. The Company’s Board of Directors has both a Compensation Committee and an Audit Committee. The Company does not have a nominating committee.

Compensation Committee

The primary responsibilities of the Compensation Committee include, without limitation, reviewing the development of an executivea compensation philosophy for the Company; origination of allCompany, reviewing the compensation packages for executive officers and engaging and overseeing compensation proposals; review of the appropriate mix of variable versus fixed compensation;consultants and review of all transactions between the Company and any executive officer or director, whether or not involving compensation. There is no authority on the part of theadvisers. The Compensation Committee tomay not delegate any of these functions to other persons.its authority. The Compensation Committee consists currently of three outside directors of the Company and, in addition, the Chairman ofoperates under resolutions adopted by the Board of the Company.Directors that may constitute a charter, a copy of which is attached hereto asAppendix B. Current members of the Compensation Committee are Dennis H. Field (Chairperson), Carl A. Bellini, and Gerald J. Laber, and Mark E. Goldstein (with Mr. Goldstein having no vote), each of whom is an independent director as defined inunder the NASDAQ rules, except for Mr. Goldstein.rules. The Compensation Committee had one meeting during 2007.

In making decisions regarding the executive compensation, the Compensation Committee requests the comments of the chief executive officerChief Executive Officer and the other executive officers about their compensation and considers a number of factors. In determining the executive compensation in 20072009 and 2008,2010, the Committee considered, among other things, the following matters:

Overview

The objectives of the Company’s compensation program;

5

What the compensation program is designed to reward;

Each element of the compensation;

How each compensation element and the Company’s decisions regarding that element fit into the Company’s overall compensation objectives and affect decisions regarding other elements?elements.

Specific Factors

Services performed and time devoted to the Company by the executive;

Amounts paid to executives in comparable companies;

The size and complexities of the Company’s business;

Successes achieved by the executive;

The executive’s abilities;

The executive’s tenure;

The Company’s financial results;

Prevailing economic conditions;

Compensation paid to other employees of the Company; and

The amount previously paid to the executive.

The Compensation Committee hashad previously determined that an outside consultant on compensation matters should be used once every three yearsperiodically to provide information about the compensation paid to the Company’s executive officers compared to compensation paid by other companies. Most recently, the Compensation Committee engaged The Hay Group in 2004 to provide this type of market analysis. The report from The Hay Group compared each element of the Company’s base salary, total cash compensation and total direct compensation for the executive officers to The Hay Group’s all company executive compensation survey and to a peer group of 14 companies in the consumer products and specialty chemical industries. This report showed, among other things, that the aggregate actual total direct compensation levels for the Company’s executive officers fell between the 25th and 50th percentile levels of the peer group market, with the Chief Executive Officer’s actual total direct compensation levels below the median of such market by approximately 20% to 25%. The Compensation Committee has not engaged aan independent compensation consultantexpert to assist the Compensation Committee in 2007evaluating the Company’s

current compensation programs and policies. The Company anticipates having the results of this compensation analysis in the third quarter of the year. To the extent such evaluation leads to changes in compensation, the Company will make any required disclosures in current or 2008 in order to save onperiodic reports it files with the costs.

The Board of DirectorsCompensation Committee also determines the fees paid to the non-employee directors. The Board does so without the use of a compensation consultant. The fees for the non-employee directors result from discussions between the executive officers and each of the non-employee directors as to a reasonable amount. The Company pays the same director fees to all non-employee directors.

Audit Committee

The Audit Committee has as itsCommittee’s primary responsibilities the appointment ofinclude appointing the independent auditor for the Company, the pre-approval ofpre-approving all audit and non-audit services, and assistance toassisting the Board of Directors in monitoring the integrity of the financial statements of the Company, the independent auditor’s qualifications, independence and performance and the Company’s compliance with legal requirements. The Audit Committee operates under a written charter adopted by the Board, of Directors, a copy of which has been filed with the SEC and is attached as an exhibit to this proxy statement.available at the Company’s website at www.scottsliquidgold.com. The current members of the Audit Committee are Gerald J. Laber (Chairperson), Carl A. Bellini and Dennis H. Field. Each member of the Audit Committee is an independent director as defined in the NASDAQ rules. Mr. Laber has the professional experience deemed necessary to qualify as an audit committee financial expert under rules of the Securities and Exchange Commission.SEC. The Audit Committee had eightfour meetings during 2007.

6

NOMINATION PROCESS

In considering an incumbent director whose term of office is to expire, the Board of Directors reviews the director’s overall service during the person’s term, the number of meetings attended, level of participation and quality of performance. In the case of new directors, the directors on the Board of Directors are asked for suggestions as to potential candidates, discuss any candidates suggested by a shareholder of the Company and apply the criteria stated below. The Company may engage a professional search firm to locate nominees for the position of director of the Company. However, to date the Board of Directors has not engaged professional search firms for this purpose. A selection of a nominee by the Board of Directors requires a majority vote of the Company’s directors. The Board of Directors consists of sevensix members of which Carl A. Bellini, Dennis H. Field, and Gerald J. Laber are independent as defined inunder NASDAQ rules.

The boardBoard seeks candidates for nomination to the position of director who have excellent decision-making ability, business experience, particularly those relevant to consumer products, personal integrity and a high reputation, diverse backgrounds and who meet such other criteria as may be set forth in a writing adopted by a majority vote of the Board.

During 2011, the Board is undertaking a search for a qualified, independent director. The Board’s preference is to nominate a candidate who has experience and expertise in consumer products marketing, advertising, branding and sales. While it is not a requirement for the Company, the goal of Directors.

Pursuant to a policy adopted by the Board, of Directors, the directors will take into consideration a director nominee submitted to the Company by a shareholder; provided that the shareholder submits the director nominee and reasonable supporting material concerning the nominee by the due date for a shareholder proposal to be included in the Company’s proxy statementProxy Statement for the applicable annual meeting as set forth in rules of the Securities and Exchange CommissionSEC then in effect. See “Shareholder Proposals” below.

The Company does not have a policy regarding attendance by members of the Board of Directors at the Company’s annual meeting of shareholders. The Company has always encouraged its directors to attend its annual meeting. In 2007,2009, the year of our last annual meeting, all directors attended the Company’s annual meeting of shareholders.

Historically, the Company has not had a formal process for stockholdershareholder communications with the Board of Directors.Board. The Company does not believe a formal process for handling stockholdershareholder communications is necessary because the Board of Directors reviews and considers all material communications from stockholders.

7

CODE OF BUSINESS CONDUCT AND ETHICS

8

EXECUTIVE COMPENSATION

SUMMARY COMPENSATION TABLE

| Non-qualified | ||||||||||||||||||||||||||||||||||||

| Non-equity | deferred | |||||||||||||||||||||||||||||||||||

| Name and | Stock | incentive plan | compensation | All Other | ||||||||||||||||||||||||||||||||

| Principal | Salary | Bonus | Awards | Option awards | compensation | earnings | Compensation | Total | ||||||||||||||||||||||||||||

| Position | Year | $(1) | $(2) | $ | $(3) | $ | $ | ($)(4) | $ | |||||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | |||||||||||||||||||||||||||

| Mark E. Goldstein | 2007 | 360,000 | — | — | 1,483 | — | — | 49,543 | 411,026 | |||||||||||||||||||||||||||

| Chairman of the | 2006 | 387,684 | — | — | — | — | — | 47,929 | 435,513 | |||||||||||||||||||||||||||

| Board, President and Chief Executive Officer | ||||||||||||||||||||||||||||||||||||

| Jeffrey R. Hinkle | 2007 | 202,500 | — | — | 1,483 | — | — | 15,232 | 219,215 | |||||||||||||||||||||||||||

| Vice President – | 2006 | 218,203 | — | — | — | — | — | 14,270 | 232,473 | |||||||||||||||||||||||||||

| Marketing and Sales | ||||||||||||||||||||||||||||||||||||

| Jeffry B. Johnson | 2007 | 171,000 | — | — | 1,483 | — | — | 11,271 | 183,754 | |||||||||||||||||||||||||||

| Treasurer and Chief | 2006 | 184,860 | — | — | — | — | — | 17,178 | 202,038 | |||||||||||||||||||||||||||

| Financial Officer | ||||||||||||||||||||||||||||||||||||

| Dennis P. Passantino | 2007 | 165,375 | — | — | 2,325 | — | — | 25,305 | 193,005 | |||||||||||||||||||||||||||

| Vice President – | 2006 | 178,152 | — | — | — | — | — | 19,258 | 197,410 | |||||||||||||||||||||||||||

| Operations and Corporate Secretary | ||||||||||||||||||||||||||||||||||||

Name and Principal Position | Salary $(1) | Bonus $(2) | Stock Awards $ | Option awards $(3) | Non-equity incentive plan compensation $ | Non-qualified deferred compensation earnings $ | All Other Compensation ($)(4) | Total $ | ||||||||||||||||||||||||||||

(a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | |||||||||||||||||||||||||||

Mark E. Goldstein Chairman of the Board, President and Chief Executive Officer | 2010 2009 | 342,000 342,000 | 23,914 | 56,614 66,706 | 422,528 408,706 | |||||||||||||||||||||||||||||||

Jeffrey R. Hinkle Vice President – Marketing and Sales | 2010 2009 | 192,375 192,375 | 24,448 | 14,129 11,969 | 230,952 204,344 | |||||||||||||||||||||||||||||||

Dennis P. Passantino Vice President – Operations and Corporate Secretary | 2010 2009 | 165,375 165,375 | 17,563 | 25,029 25,640 | 207,967 191,015 | |||||||||||||||||||||||||||||||

Brian L. Boberick Controller until February 2009; Treasurer and Chief Financial Officer commencing on February 24, 2009 | 2010 2009 | 135,000 130,708 | 3,804 3,511 | 27,494 23,588 | 166,298 157,807 | |||||||||||||||||||||||||||||||

| (1) | September |

| (2) | The Company | |

| (3) | Amounts shown in the column “Option Awards” |

9

| (4) | The dollar amount of All Other |

| Mark E. Goldstein | Jeffrey R. Hinkle | |||||||||||||||

| 2007 | 2006 | 2007 | 2006 | |||||||||||||

| Automobile purchase (a) | $ | — | $ | — | $ | — | $ | — | ||||||||

| Income taxes on automobile purchase (a) | — | — | — | — | ||||||||||||

| Other automobile expenses | 3,958 | 4,122 | 2,319 | 391 | ||||||||||||

| Memberships | 23,009 | 22,887 | — | — | ||||||||||||

| Life insurance | 2,546 | 2,412 | 1,478 | 1,478 | ||||||||||||

| Income taxes on life insurance | 1,941 | 1,839 | 1,035 | 1,035 | ||||||||||||

| Medical plan (b) | 8,725 | 5,785 | 3,638 | 2,908 | ||||||||||||

| Disability insurance | 4,672 | 4,672 | 4,987 | 4,987 | ||||||||||||

| ESOP (c) | 1,960 | 3,480 | 1,775 | 3,471 | ||||||||||||

| Other | 2,732 | 2,732 | — | — | ||||||||||||

| Total other compensation | $ | 49,543 | $ | 47,929 | $ | 15,232 | $ | 14,270 | ||||||||

| Jeffry B. Johnson | Dennis P. Passantino | |||||||||||||||

| 2007 | 2006 | 2007 | 2006 | |||||||||||||

| Automobile purchase (a) | $ | — | $ | — | $ | 7,349 | $ | 7,349 | ||||||||

| Income taxes on automobile purchase (a) | — | — | 5,155 | 5,155 | ||||||||||||

| Other automobile expenses | 2,896 | 1,263 | 818 | 313 | ||||||||||||

| Memberships | — | — | — | — | ||||||||||||

| Life insurance | 2,044 | 4,332 | 966 | 966 | ||||||||||||

| Income taxes on life insurance | 1,434 | 3,039 | 678 | 678 | ||||||||||||

| Medical plan (b) | 2,548 | 4,649 | 2,908 | 1,369 | ||||||||||||

| Disability insurance | 845 | 929 | 5,938 | 514 | ||||||||||||

| ESOP (c) | 1,504 | 2,966 | 1,493 | 2,914 | ||||||||||||

| Other | — | — | — | — | ||||||||||||

| Total other compensation | $ | 11,271 | $ | 17,178 | $ | 25,305 | $ | 19,258 | ||||||||

| Mark E. Goldstein | Jeffrey R. Hinkle | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

Automobile lease/allowance(a) | $ | 9,081 | $ | 12,961 | $ | — | $ | — | ||||||||

Income taxes on automobile lease/allowance(a) | 6,890 | 9,832 | — | — | ||||||||||||

Other automobile expenses | 953 | 1,810 | 1,012 | 668 | ||||||||||||

Memberships | 16,884 | 16,882 | — | — | ||||||||||||

Life insurance | 4,716 | 4,716 | 1,814 | 1,814 | ||||||||||||

Income taxes on life insurance | 3,578 | 3,578 | 1,280 | 1,280 | ||||||||||||

Medical plan(b) | 5,421 | 8,288 | 3,814 | 2,354 | ||||||||||||

Disability insurance | 4,672 | 4,672 | 4,987 | 4,987 | ||||||||||||

ESOP(c) | 1,545 | 1,094 | 1,222 | 866 | ||||||||||||

Other | 2,874 | 2,873 | — | — | ||||||||||||

Total other compensation | $ | 56,614 | $ | 66,706 | $ | 14,129 | $ | 11,969 | ||||||||

| Dennis P. Passantino | Brian L. Boberick | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | |||||||||||||

Automobile lease/allowance(a) | $ | 6,066 | $ | 7,341 | $ | 6,000 | $ | 5,125 | ||||||||

Income taxes on automobile lease/allowance(a) | 4,274 | 5,165 | 4,225 | 3,608 | ||||||||||||

Other automobile expenses | 858 | 477 | 401 | 757 | ||||||||||||

Memberships | — | — | — | — | ||||||||||||

Life insurance | 1,245 | 1,245 | 2,719 | 4,065 | ||||||||||||

Income taxes on life insurance | 876 | 875 | 1,915 | 2,862 | ||||||||||||

Medical plan(b) | 8,269 | 6,644 | 8,991 | 5,305 | ||||||||||||

Disability insurance | 2,365 | 3,127 | 2,314 | 1,228 | ||||||||||||

ESOP(c) | 1,076 | 766 | 929 | 638 | ||||||||||||

Other | — | — | — | — | ||||||||||||

Total other compensation | $ | 25,029 | $ | 25,640 | $ | 27,494 | $ | 23,588 | ||||||||

| (a) | ||

| (b) | In addition to group life, health, hospitalization and medical reimbursement plans which generally are available to all employees, the Company has adopted a plan which provides for additional medical coverage of not more than $50,000 per year to each of the |

10

| (c) |

Executive officers and non-employee directors of the Company are eligible to receive stock awards under the Company’s 1998 Stock Option Plan and 2005 Stock Incentive Plan as amended, which expireexpires on November 9, 2008 and March 31, 2015. The number of shares available under the 1998 Plan and 2005 Plan are 1,100,000 and 600,000is 1,500,000 shares of common stock.stock; however, under Proposal 2 of this Proxy Statement, shareholders are being asked to approve of an increase in the number of available shares to a total of 3,000,000. The 1998 Plan provides for the issuance of incentive stock options or non-qualified stock options; the 2005 Plan provides for the issuance of stock awards consisting of incentive and non-qualified stock options, stock appreciation rights, restrictiverestricted stock or restrictive

restricted stock units. To date, the Company has only granted stock options under its plans. Eligible persons are full-time employees and non-employee directors for purposes ofunder the 19982005 Plan and they are full-time and part-time employees, non-employee directors and consultants under the 2005 Plan.consultants. Under the 2005 Plan, stock awards vest upon a change in control. All options granted in or prior to 20072006 were 100% vested on the date of grant. Options granted in 2007 andafter 2006 including those granted to date in 20082011 vest 1/1/48 of the shares subject to the options each month after the date of grant and upon a change in control.

Option Grants in 2007

On February 27, 2007,24, 2009, the Company’s Board of Directors granted five-year options, effective February 26, 2009, for a total of 448,55090,000 shares of common stock to employees,an executive officersofficer and certain non-employee directors at an exercise price of $0.82$0.17 per share (the closing market price on February 27, 2007), except the exercise price is $0.902 per share for Mr. Goldstein. These options vest at 1/48 per month from the date of grant or upon a change in control as indicated above.26, 2009). The number of shares subject to these options were 16,200 for each of Mr. Goldstein, Mr. Hinkle and Mr. Johnson, 26,20030,000 for Mr. Passantino (of which 10,000 replaced an expired option), 50,000Laber, 30,000 for Mr. Bellini (replacing an expired option), 100,000 for Mr. Field (replacing an expired option),Boberick and 30,000 for Mr. Laber.

Option Grants in 2010

On May 13, 2010, the Company’s Board granted five-year options, effective on that date, for a total of 357,000 shares of common stock to the four executive officers and two non-employee directors at an exercise price of $0.22 per share (the closing market price on May 13, 2010), except in the case of Mr. Goldstein whose options have an exercise price of $0.24, representing 110% of the closing market price. The number of shares subject to these options were 42,00080,000 each for Mr. Goldstein, Mr. Hinkle, Mr. Passantino and Mr. Johnson, (replacing an expired option) and 57,00030,000 for Mr. Passantino (replacing an expired option).

11

The following table summarizes information with respect to each person’s outstanding stock options at December 31, 2007.

| OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2007 | ||||||||||||||||||||||||||||||||||||

| Stock Awards | ||||||||||||||||||||||||||||||||||||

| Equity | ||||||||||||||||||||||||||||||||||||

| Option Awards | incentive | Equity | ||||||||||||||||||||||||||||||||||

| Equity | plan | incentive plan | ||||||||||||||||||||||||||||||||||

| incentive | awards: | awards: | ||||||||||||||||||||||||||||||||||

| plan | Number of | Market or payout | ||||||||||||||||||||||||||||||||||

| awards: | Market | unearned | value of | |||||||||||||||||||||||||||||||||

| Number of | Number of | Number of | Number of | value of | shares, | unearned | ||||||||||||||||||||||||||||||

| securities | securities | securities | shares or | shares or | units or | shares, | ||||||||||||||||||||||||||||||

| underlying | underlying | underlying | units of | units of | other | units or | ||||||||||||||||||||||||||||||

| unexercised | unexercised | unexercised | Option | stock that | stock that | rights that | other rights | |||||||||||||||||||||||||||||

| options | options | unearned | exercise | Option | have not | have not | have not | that have | ||||||||||||||||||||||||||||

| # | # | options | price | expiration | vested | vested | vested | not vested | ||||||||||||||||||||||||||||

| Name | Exercisable | Unexercisable | # | $ | date | # | $ | # | $ | |||||||||||||||||||||||||||

| (a) | (b) | (c) | (d) | (e) | (f) | (g) | (h) | (i) | (j) | |||||||||||||||||||||||||||

| Mark E. Goldstein | 70,500 | — | — | 0.68 | Nov. 27, 2008 | — | — | — | — | |||||||||||||||||||||||||||

| 80,000 | — | — | 0.59 | May 3, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 50,000 | — | — | 0.66 | Aug. 22, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 18,400 | — | — | 1.06 | Dec. 13, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 3,375 | (1) | 12,825 | (1) | — | 0.90 | Feb. 26, 2012 | — | — | — | |||||||||||||||||||||||||||

| Jeffrey R. Hinkle | 79,000 | — | — | 0.62 | Nov. 27, 2008 | — | — | — | — | |||||||||||||||||||||||||||

| 80,000 | — | — | 0.54 | May 3, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 50,000 | — | — | 0.60 | Aug. 22, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 18,400 | — | — | 0.96 | Dec. 13, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 3,375 | (1) | 12,825 | (1) | — | 0.82 | Feb. 26, 2012 | — | — | — | — | ||||||||||||||||||||||||||

| Jeffry B. Johnson | 42,000 | — | — | 0.46 | Feb. 24, 2008 | — | — | — | — | |||||||||||||||||||||||||||

| 8,000 | — | — | 0.62 | Nov. 27, 2008 | — | — | — | — | ||||||||||||||||||||||||||||

| 80,000 | — | — | 0.54 | May 3, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 50,000 | — | — | 0.60 | Aug. 22, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 18,400 | — | — | 0.96 | Dec. 13, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 3,375 | (1) | 12,825 | (1) | — | 0.82 | Feb. 26, 2012 | — | — | — | — | ||||||||||||||||||||||||||

| Dennis P. Passantino | 77,000 | — | — | 0.46 | Feb. 24, 2008 | — | — | — | — | |||||||||||||||||||||||||||

| 8,000 | — | — | 0.62 | Nov. 27, 2008 | — | — | — | — | ||||||||||||||||||||||||||||

| 80,000 | — | — | 0.54 | May 3, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 5,000 | — | — | 0.60 | Aug. 22, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 18,400 | — | — | 0.96 | Dec. 13, 2010 | — | — | — | — | ||||||||||||||||||||||||||||

| 5,458 | (1) | 20,742 | (1) | — | 0.82 | Feb. 26, 2012 | — | — | — | — | ||||||||||||||||||||||||||

OUTSTANDING EQUITY AWARDS AT DECEMBER 31, 2010 Name (a) Mark E. Goldstein Jeffrey R. Hinkle Dennis P. Passantino Brian L. Boberick Option Awards Stock Awards Number

of

securities

underlying

unexercised

options

#

Exercisable

(b) Number

of securities

underlying

unexercised

options

#

Unexercisable

(c) Equity

incentive

plan

awards:

Number of

securities

underlying

unexercised

unearned

options

#

(d) Option

exercise

price

$

(e) Option

expiration

date

(f) Number

of

shares

or units

of stock

that

have

not

vested

#

(g) Market

value

of

shares

or

units of

stock

that

have

not

vested

$

(h) Equity

incentive

plan

awards:

Number

of

unearned

shares,

units or

other

rights

that have

not

vested

#

(i) Equity

incentive

plan

awards:

Market

or

payout

value of

unearned

shares,

units or

other

rights

that have

not

vested

$

(j) 15,525 (1) 675 — 0.90 Feb. 26, 2012 — — — — 36,719 (4) 33,781 — 0.19 Nov. 27, 2013 — — — — 12,500 (7) 67,500 — 0.24 May 12, 2015 — — — — 4,688 (8) 45,312 — 0.25 Aug. 9, 2015 — — — — 192 (9) 18,208 — 0.22 Dec. 13, 2015 — — — — 15,525 (1) 675 — 0.82 Feb. 26, 2012 — — — — 41,146 (4) 37,854 — 0.17 Nov. 27, 2013 — — — — 12,500 (7) 67,500 — 0.22 May 12, 2015 — — — — 4,688 (8) 45,312 — 0.23 Aug. 9, 2015 — — — — 192 (9) 18,208 — 0.20 Dec. 13, 2015 — — — — 25,108 (1) 1,092 — 0.82 Feb. 26, 2012 — — — — 40,375 (3) 16,625 — 0.55 Feb. 25, 2013 — — — — 4,167 (4) 3,833 — 0.17 Nov. 27, 2013 — — — — 12,500 (7) 67,500 — 0.22 May 12, 2015 — — — — 469 (8) 4,531 — 0.23 Aug. 9, 2015 — — — — 192 (9) 18,208 — 0.20 Dec. 13, 2015 — — — — 7,083 (1) 2,917 — 0.82 Feb 26, 2012 — — — — 1,750 (2) 1,250 — 0.82 Sep. 3, 2012 — — — — 2,292 (3) 2,708 — 0.55 Feb. 25, 2013 — — — — 6,250 (5) 23,750 — 0.17 Feb. 23, 2014 — — — — 250 (6) 2,750 — 0.25 Aug. 10, 2014 — — — — 1094 (7) 5,906 — 0.22 May 12, 2015 — — — — 192 (9) 18,208 — 0.20 Dec. 13, 2015 — — — —

| (1) | These options were granted on February 27, 2007 and vest |

12

| (2) | These options were granted on September 4, 2007 and vest1/ 48 per month from date of grant. |

| (3) | These options were granted on February 26, 2008 and vest1/ 48 per month from date of grant. |

| (4) | These options were granted on November 28, 2008 and vest1/ 48 per month from date of grant. |

| (5) | These options were granted on February 24, 2009 and vest1/ 48 per month from date of grant. |

| (6) | These options were granted on August 11, 2009 and vest1/ 48 per month from date of grant. |

| (7) | These options were granted on May 13, 2010 and vest1/ 48 per month from date of grant. |

| (8) | These options were granted on August 10, 2010 and vest1/ 48 per month from date of grant. |

| (9) | These options were granted on December 14, 2010 and vest1/ 48 per month from date of grant. |

| director compensation | ||||||||||||||||||||||||||||

| Non-Qualified | ||||||||||||||||||||||||||||

| Non-Equity | Deferred | |||||||||||||||||||||||||||

| Fees Earned | Stock | Option | Incentive Plan | Compensation | All Other | |||||||||||||||||||||||

| Name | or Paid in Cash | Awards | Awards | Compensation | Earnings | Compensation | Total | |||||||||||||||||||||

| ($) | ($) | ($) | ($) | ($) | ($) | ($) | ||||||||||||||||||||||

| (a) | (b) | (c) | (d)(1) | (e) | (f) | (g) | (j) | |||||||||||||||||||||

| Carl A. Bellini | 27,000 | — | 4,438 | — | — | — | 31,438 | |||||||||||||||||||||

| Dennis H. Field | 27,000 | — | 8,875 | — | — | — | 35,875 | |||||||||||||||||||||

| Gerald J. Laber | 27,000 | — | 2,663 | — | — | — | 29,663 | |||||||||||||||||||||

DIRECTOR COMPENSATION FOR 2010 | ||||||||||||||||||||||||||||

Name (a) | Fees Earned or Paid in Cash ($) (b) | Stock Awards ($) (c) | Option Awards ($) (d)(1) | Non-Equity Incentive Plan Compensation ($) (e) | Non-Qualified Deferred Compensation Earnings ($) (f) | All Other Compensation ($) (g) | Total ($ ) (j) | |||||||||||||||||||||

Carl A. Bellini | 13,500 | — | 13,763 | — | — | — | 27,263 | |||||||||||||||||||||

Dennis H. Field | 13,500 | — | 3,824 | — | — | — | 17,324 | |||||||||||||||||||||

Gerald J. Laber | 15,000 | — | 8,753 | — | — | — | 23,753 | |||||||||||||||||||||

Jeffry B. Johnson | 13,500 | — | 24,469 | — | — | — | 37,969 | |||||||||||||||||||||

| (1) | Amounts shown in the column “Option Awards” |

The following table summarizes information with respect to each non-employee director’s outstanding stock options at December 31, 2007:

| Outstanding Options at December 31, 2007 | ||||||||||||||||

| Number of Securities | Number of Securities | |||||||||||||||

| Underlying Unexercised | Underlying Unexercised | Option | ||||||||||||||

| Options | Options | Exercise | Option | |||||||||||||

| # | # | Price | Expiration | |||||||||||||

| Name | Exercisable | Unexercisable | $ | Date | ||||||||||||

| Carl A. Bellini | 30,000 | — | 0.54 | May 4, 2010 | ||||||||||||

| 30,000 | — | 0.60 | August 22, 2010 | |||||||||||||

| 25,000 | — | 0.60 | August 22, 2010 | |||||||||||||

| 10,417 | (1) | 39,583 | (1) | 0.82 | February 26, 2012 | |||||||||||

| Dennis H. Field | 45,000 | — | 0.62 | November 27, 2008 | ||||||||||||

| 25,000 | — | 0.60 | August 22, 2010 | |||||||||||||

| 20,833 | (1) | 79,167 | (1) | 0.82 | February 26, 2012 | |||||||||||

| Gerald J. Laber | 30,000 | — | 0.76 | February 25, 2009 | ||||||||||||

| 30,000 | — | 0.60 | August 22, 2010 | |||||||||||||

| 30,000 | — | 0.96 | December 13, 2010 | |||||||||||||

| 6,250 | (1) | 23,750 | (1) | 0.82 | February 26, 2012 | |||||||||||

13

| Outstanding Options at December 31, 2010 | ||||||||||||||||

Name | Number of Securities Underlying Unexercised Options # Exercisable | Number of Securities Underlying Unexercised Options # Unexercisable | Option Exercise Price $ | Option Expiration Date | ||||||||||||

Carl A. Bellini | 47,917 | (1) | 2,083 | 0.82 | Feb. 26, 2012 | |||||||||||

| 13,750 | (4) | 16,250 | 0.17 | Feb. 23, 2014 | ||||||||||||

| 4,688 | (5) | 25,312 | 0.22 | May 12, 2015 | ||||||||||||

| 5,156 | (6) | 49,844 | 0.23 | Aug. 9, 2015 | ||||||||||||

Dennis H. Field | 95,833 | (1) | 4,167 | 0.82 | Feb. 26, 2012 | |||||||||||

| 23,438 | (2) | 21,562 | 0.17 | Nov. 27, 2013 | ||||||||||||

| 2,344 | (6) | 22,656 | 0.23 | Aug. 9, 2015 | ||||||||||||

Gerald J. Laber | 28,750 | (1) | 1,250 | 0.82 | Feb. 26, 2012 | |||||||||||

| 13,750 | (4) | 16,250 | 0.17 | Feb. 23, 2014 | ||||||||||||

| 2,813 | (6) | 27,187 | 0.23 | Aug. 9, 2015 | ||||||||||||

| 313 | (7) | 29,687 | 0.20 | Dec. 13, 2015 | ||||||||||||

Jeffry B. Johnson | 15,525 | (1) | 675 | 0.82 | Feb. 26, 2011 | |||||||||||

| 29,750 | (3) | 12,250 | 0.55 | Feb. 25, 2013 | ||||||||||||

| 4,167 | (4) | 3,833 | 0.17 | Nov. 27, 2013 | ||||||||||||

| 12,500 | (5) | 67,500 | 0.22 | May 12, 2015 | ||||||||||||

| 4,688 | (6) | 45,312 | 0.23 | Aug. 9, 2015 | ||||||||||||

| 192 | (7) | 18,208 | 0.20 | Dec. 31, 2015 | ||||||||||||

| (1) | These options were granted on February 27, 2007 and vest |

| (2) | These options were granted on November 28, 2008 and vest1/ 48 per month from the date of grant. |

| (3) | These options were granted on February 26, 2008 and vest1/ 48 per month from the date of grant. |

| (4) | These options were granted on February 24, 2009 and vest1/ 48 per month from the date of grant. |

| (5) | These options were granted on May 13, 2010 and vest1/ 48 per month from the date of grant. |

| (6) | These options were granted on August 10, 2010 and vest1/ 48 per month from the date of grant. |

| (7) | These options were granted on December 14, 2010 and vest1/ 48 per month from the date of grant. |

PROPOSAL 2: AMENDMENT TO STOCK INCENTIVE PLAN

Amendment

The Company’s Board amended on March 16, 2011, the Company’s 2005 Stock Incentive Plan (the “2005 Plan”) to increase the number of shares of common stock available under the 2005 Plan by 900,0001,500,000 shares of common stock, less thefor a total authorized number of shares issued after the effective date of the amendment as a result of the exercise of stock options under the 1997 Stock Option Plan and the 1998 Stock Option Plan. (The 1997 and 1998 Plans only provide for options.)3,000,000 shares. The amendment increasing the number of shares under the 2005 Plan is subject to approval of the Company’s shareholders.shareholders and is included asAppendix A hereto. The effective date of the amendment will be the date of shareholder approval.

Prior to the amendment, 600,0001,500,000 shares have been available under the 2005 Plan. After the amendment, the total number of shares available under the 2005 Plan will be 1,500,000 shares, less the number of shares issued after the effective date as a result of the exercise of options under the 1997 and 1998 Plans. (Shares subject to options that expire without being exercised will not be subtracted.)3,000,000 shares. The reasons for the amendment to the 2005 Plan include:

The Company’s Board believes that the Company must have available and grant options to employees in order to retain employees in a competitive environment, particularly employees who are subject to the Company’s salary and wage freeze.

The 2005 Plan is the only stock plan of the Company’s under which grants may be made. The increase in options is intended in part to replace options which expire, without being exercised, under the Company’s 1997 Stock Option Plan and 1998 Stock Option Plan. See “Shares Under All Plans as of March 31, 2011” below. Stock options issued under the 1997 and 1998 Plans remain outstanding after the expiration of those Plans and continue for the term of the options, which has typically been five years from the date of grant. The amendment will subtract from the total number of shares available under the 2005 Plan the number of shares which are actually issued under the 1997 and 1998 Plans. Options reward persons who have stayed with the Company. Options provide an incentive on the part of officers and other employees, as well as directors, to improve the Company’s performance. The grant of options aligns the goals of the optionees with those of the shareholders. The options provide to directors and executive officers a meaningful stake in the Company. | |||

14

As of

The Company currently has outstanding options under three stock option plans. They are the 1997 Stock Option Plan (for which the executive officers and directors are ineligible), the Company’s 1998 Stock Option Plan and the 2005 Plan. The number of shares available under the Plans are shown in the following table:

| 2005 Plan | ||||||||||||||||

| 1997 Plan | 1998 Plan | With Amendment | Total | |||||||||||||

| Shares authorized | 300,000 | 1,100,000 | 1,500,000 | (1)(2) | 2,900,000 | (1)(2) | ||||||||||

| Shares subject to outstanding options | 287,000 | 1,048,500 | 585,900 | 1,922,150 | ||||||||||||

| Shares previously issued upon exercise of options | — | 22,000 | — | 22,000 | ||||||||||||

| Shares available for option grants | (Expired) | 29,500 | 914,100 | 943,600 | ||||||||||||

| (Expires | (Expires | |||||||||||||||

| November 8, 2008) | March 31, 2015) | |||||||||||||||

| 2005 Plan(3) | ||||||||||||||||

| 1997 Plan | 1998 Plan | With Amendment | Total | |||||||||||||

Shares authorized for future issuances | — | — | 3,000,000 | (1)(2) | 3,000,000 | (1)(2) | ||||||||||

Shares subject to outstanding options | 240,500 | 296,900 | 1,396,150 | 1,933,550 | ||||||||||||

Shares previously issued upon exercise of options | — | 22,000 | 3,500 | 25,500 | ||||||||||||

Shares available for option grants | 1,600,350 | 1,040,950 | (2) | |||||||||||||

| (1) | Includes 1,500,000 shares added by the amendment being submitted to the shareholders for approval. | |

| (2) | The number of shares under the 2005 Plan is decreased by options exercised under the 1997 and 1998 Plans after |

| (3) | Expires on March 31, 2015. |

Significant features of the 2005 Plan are summarized below, as currently in effect and as the 2005 Plan will be in effect after the amendment which solely increases the number of shares.shares available for awards. This summary is qualified in its entirety by reference to the full text of the 2005 Plan which is available from the Company and is an exhibit to filings with the Securities and Exchange Commission.

General

In March, 2005, the Company’s Board of Directors adopted the 2005 Plan, subject to approval and ratification by shareholders. The shareholders approved the 2005 Plan in May 2005.

The 2005 Plan provides that the 2005 Plan administrator may issue stock awards consisting of incentive and non-qualified stock options, stock appreciation rights, restricted stock and restricted stock units. The 2005 Plan administrator may grant one or more of these types of awards. The Board will administer the 2005 Plan unless the Board delegates the administration of the 2005 Plan to a committee, which will be appointed by and serve at the pleasure of the Board. The 2005 Plan administrator determines and designates from time to time

15

Shares Subject to 2005 Plan; Limitations

The aggregate number of shares of Common Stock that may be issued under awards granted pursuant to the 2005 Plan will be 1,500,0003,000,000 shares of the Company’s common stock, less the number of shares issued after the effective date of the amendment as a result of the exercise of options under the 1997 and 1998 Plans.Plans, after May 6, 2008. If there is a stock dividend, subdivision, reclassification, recapitalization, merger, consolidation, stock split, combination or exchange of stock, or other event described under the terms of the 2005 Plan, the administrator will make appropriate adjustments to the total number of shares available under the 2005 Plan and to outstanding awards. If an outstanding award expires or ceases to be exercisable, the shares that were subject to the award will continue to be available under the 2005 Plan.

During any single calendar year, no participant will be eligible to be granted awards exceeding 10% of the limit on shares under the 2005 Plan. From March, 2005 to the date on which the 2005 Plan terminates, no participant will be eligible to be granted awards exceeding 20% of the limit on shares.

Term of 2005 Plan

The 2005 Plan was effective as of March 31, 2005. The 2005 Plan will terminate on March 31, 2015, unless terminated earlier by the Board. Termination of the 2005 Plan will not affect grants made prior to termination.

Eligibility

All full-time and part-time employees are eligible to receive any award under the 2005 Plan. Directors and consultants of the Company and its subsidiaries, who are not employees, are eligible to receive any award, other than incentive stock options, under the 2005 Plan.

Securities Issuable Under the 2005 Plan

Stock Options

The exercise price for an option granted under the 2005 Plan must not be less than 100% of the fair market value of the shares subject to the option at the date of grant. No option will be repriced. The term of each option may not be more than ten years from the date of grant. An option is fully vested unless otherwise provided by the 2005 Plan administrator in the option agreement. A participant may pay the exercise price and withholding taxes in cash or, upon approval of the 2005 Plan administrator, in common stock of the Company or another form of legal consideration. No incentive stock option may be granted to an employee who, at the time the incentive stock option is granted, owns stock (as determined in accordance with the Internal Revenue Code) representing more than 10% of the total combined voting power of all classes of stock of the Company or of any parent or subsidiary, unless the option price of such incentive stock option is at least 110% of the fair market

16

Stock Appreciation Rights

A stock appreciate right, or SAR, is exercisable for the receipt of a number of shares of common stock having a fair market value equal to (1) the fair market value on the date of exercise of the number of shares as to which the SAR has been exercised over (2) the aggregate exercise price of the SAR for such number of shares. The exercise price for each SAR will be no less than the fair market value of the common stock at the time the SAR is granted. No SAR will be repriced. The term of any SAR may not

exceed ten years from the date of grant. SARs will be fully vested unless otherwise determined by the 2005 Plan administrator and stated in a stock appreciation rights agreement.

Restricted Stock and Restricted Stock Units

Restricted stock may be granted to a participant without the payment of a purchase price. If a grant of restricted stock requires the payment of a purchase price, the purchase price of the restricted stock may not be repriced. If restricted stock has a purchase price, a participant must pay the purchase price in cash or, upon approval of the 2005 Plan administrator, in common stock or another form of legal consideration. If a participant fails to satisfy any applicable restriction (including vesting requirements) on the restricted stock, the restricted stock will be forfeited to the Company in return for no consideration or such consideration as specified in the applicable award agreement. Restricted stock constitutes issued and outstanding shares of common stock for all corporate purposes. The participant will have the right to vote the restricted stock, to receive and retain all regular cash dividends and such other distributions as the Board may, in its discretion, pay on the common stock, and to exercise all other rights, powers and privileges of a holder of common stock.

A restricted stock unit represents an obligation of the Company to deliver a specific number of shares of common stock to the participant on a specified date. Any award of restricted stock or an RSU will be fully vested or will vest in accordance with a vesting schedule provided in the agreement for that award as determined by the 2005 Plan administrator.

Valuation

For purposes of the 2005 Plan, the fair market value of common stock means the average of the closing sales prices for the common stock on its trading market for the five preceding trading days as reported in The Wall Street Journal or another publication or source for market prices selected by the Board of Directors.Board. If there has not been trading of the common stock on a specific day, then a trading day is the next preceding day on which there was such trading. If closing sales prices are not available for the trading market, the average of the closing bid and asked prices are used. If none of these alternatives are available, the 2005 Plan administrator will determine the fair market value by applying any reasonable valuation method.

Change in Control

If a change in control event occurs, then the vesting of all awards held by participants in continuous service at the time will be accelerated in full. In anticipation of a change in control event, the 2005 Plan

17

Termination of Continuous Service

Any vesting of an award ceases upon termination of a participant’s service with the Company. A stock option or SAR will terminate and may not be exercised after three months after a participant’s

service with the Company ceases for any reason other than cause, disability or death. If a participant ceases service with the Company for cause or if the participant breaches any covenant not to compete or non-disclosure agreement, an unexercised stock option or SAR terminatesshall terminate immediately. If a participant ceases their service with the Company due to death or disability, an outstanding stock option or SAR will be exercisable for one year after that time but not later than the expiration date of the award. The 2005 Plan administrator may in its discretion extend the dates for termination of awards as stated in this paragraph.

If a participant terminates service with the Company for any reason, any unvested restricted stock or unvested RSUs held by the participant as of the date of termination of service will be forfeited to the Company unless otherwise provided in an applicable award agreement.

Amendment of 2005 Plan

The Board may at any time and from time to time alter, amend, suspend or terminate the 2005 Plan or any part thereof as it may deem proper, except that no such action can diminish or impair the rights under an award previously granted. However, approval of the stockholdersshareholders shall be required to increase the total number of shares issuable under the 2005 Plan, to reduce the exercise price for any option, SAR or RSU or the purchase price for any restricted stock below a level required by the 2005 Plan or to modify materially requirements for eligibility under the 2005 Plan. The 2005 Plan administrator may modify, extend or renew outstanding awards except that this action must not diminish or impair the rights of a previously granted award without the consent of the participant.

18

The rules governing the tax treatment of stock awards granted under the 2005 Plan depend largely on the surrounding facts and circumstances. Generally, under current federal income tax laws, a participant will recognize income, and the Company will be entitled to a deduction as follows:

Stock Options

If an employee does not dispose of the shares acquired pursuant to the exercise of an incentive stock option within one year after the transfer of the shares to the participant and within two years from the grant of the option, the employee will not realize taxable income as a result of the grant or exercise of the option (except for purposes of the alternative minimum tax upon the exercise of the option), and any gain or loss that is subsequently realized may be treated as a long term capital gain or loss, depending on the circumstances. The Company will not be able to deduct any amount for the grant of the incentive stock option or the transfer of shares upon exercise. If the employee disposes of the stock prior to one year after the transfer of the shares (or two years prior to the option grant date), the participant will realize ordinary income in an amount equal to the lesser of (a) the excess of the fair market value of the common stock acquired on the date of exercise over the exercise price or (b) the gain recognized on such disposition. Upon the exercise of a nonqualified stock option, the participant will generally realize ordinary income equal to the excess of the fair market value of the shares on the date of exercise over the exercise price. The Company will be able to deduct an amount equal to the ordinary income realized by the participant.

Restricted Stock

A participant who receives an award of restricted stock will realize ordinary income (on a per share basis) at the time any restrictions lapse equal to the difference between the fair market value of the common stock at the time such restrictions lapse and the amount (if any) paid for the stock. Alternatively,

under Section 83 of the Internal Revenue Code, the participant may elect to accelerate the tax event and realize ordinary income (on a per share basis) equal to the difference between the purchase price (if any) of the common stock and the fair market value of the common stock on the date of grant upon the receipt of an award of restricted stock. When the participant recognizes ordinary income, the Company will be able to deduct an amount equal to the ordinary income recognized by the participant.

Restricted Stock Units

A participant who is granted an RSU will generally not recognize any income upon the grant of the award. The participant will generally recognize as ordinary income an amount equal to the fair market value of any shares transferred to the participant upon the vesting of such award. The Company will ordinarily be entitled to a deduction, in the amount of the ordinary income recognized by the participant, at the same time the participant recognizes such income, so long as the amount constitutes reasonable compensation.

19

Upon the exercise of any SAR, the value of any stock received will constitute ordinary income to the participant equal to the fair market value of the shares transferred to a participant upon the exercise. The Company will ordinarily be entitled to a deduction in the same amount and at the same time, so long as the amount constitutes reasonable compensation.

Section 409A

Section 409A, a section added to the Code in 2004, can affect the tax treatment of certain types of deferred compensation. Failure to comply with the requirements of Section 409A results in current income of amounts deferred, along with interest and a significant tax penalty. Certain types of equity-based compensation are exempt from Section 409A. The Company intends to operate the 2005 Plan so that all grants under the 2005 Plan are exempt from Section 409A.

Amendment Benefits

As of the date of this proxy statement,Proxy Statement, no executive officer, employee, director or consultant has been granted any award based upon the proposed amendment to the 2005 Plan. The benefits to be received by the eligible participants pursuant to the proposed amendment to the 2005 Plan are not determinable at this time.

20

The following table provides, as of December 31, 2007,2010, information regarding the Company’s equity compensation plans, which consist of the 1997 and 1998 Stock Option Plans and the 2005 Plan. The 1997 Plan expired in 2007; and accordingly no shares are available for future option grants under that Plan.plans. The Company also has an Employee Stock Ownership Plan which invests only in common stock of the Company, but which is not included in the table below.

| Number of | ||||||||||||

| Securities | ||||||||||||

| to be issued | Number of securities | |||||||||||

| upon | remaining available for | |||||||||||

| exercise of | Weighted-average | future issuance under | ||||||||||

| outstanding | exercise price of | equity compensation | ||||||||||

| options, | outstanding | plans | ||||||||||

| warrants and | options, | (excluding securities | ||||||||||

| rights | warrants and rights | reflected in column (a)) | ||||||||||

| Plan Category | (a) | (b) | (c) | |||||||||

| Equity compensation plans approved by security holders | 1,942,150 | $ | 0.69 | 43,600 | ||||||||

| Equity compensation plans not approved by security holders | -0- | -0- | -0- | |||||||||

| Total | 1,942,150 | $ | 0.69 | 43,600 | ||||||||

Plan Category

| Number of Securities to be issued upon exercise of outstanding options, warrants and rights (a)

| Weighted average exercise price of outstanding options, warrants and rights (b)

| Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c)

| |||

| Equity compensation plans approved by security holders | 1,933,550 | $0.39 | 100,350 | |||

| Equity compensation plans not approved by security holders | __ | __ | __ | |||

Total | 1,933,550 | $0.39 | 100,350 |

Vote required and Recommendation

The approval of the amendment to the 2005 Plan requires a majority of shares present and voting at the Meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO THE 2005 PLAN

The Company has indemnification agreements with each of its directors and executive officers. These agreements provide for indemnification and advancement of expenses to the full extent permitted by law in connection with any proceeding in which the person is made a party because the person is a director or officer of the Company. They also state certain procedures, presumptions and terms relevant to indemnification and advancement of expenses.

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and beneficial owners of more than 10% of the outstanding shares of the Company to file with the Securities and Exchange CommissionSEC reports regarding changes in their beneficial ownership of shares in the Company. To the Company’s knowledge, based solely upon review of Forms 3, 4 and 5, and amendments thereto furnished to the Company, there was full compliance with all Section 16(a) filing requirements applicable to those persons for reports filed in 2007, except that reports for the grant of stock options on February 27, 2007 to each of the directors and executives were filed approximately one week after their due date.

212010.

General

Ehrhardt Keefe Steiner & Hottman PC, has been selected by the Audit Committee of the Board of Directorsan independent registered public accounting firm, served as the Company’s independent auditors for the fiscal year ended December 31, 2008.2010 and has been selected by the Audit Committee of the Board as the Company’s independent auditors for the fiscal year ending December 31, 2011. Ehrhardt Keefe Steiner and& Hottman PC has been the Company’s independent auditors since June 2003. A representative of Ehrhardt Keefe Steiner & Hottman PC is expected to be present at the Annual Meeting of Shareholders and to have the opportunity to make a statement if the representative so desires. Such representative also is expected to be available to respond to appropriate questions at that time.

REPORT OF AUDIT COMMITTEE

March 16, 2011

To the Board of Directors of Scott’s Liquid Gold-Inc.:

We have reviewed and discussed with management the Company’s audited financial statements. We have discussed with Ehrhardt Keefe Steiner & Hottman PC, its independent auditors, the matters required to be discussed by Statement on Auditing Standards No. 61,114,The Auditors’ Communication with Audit Committees,Those Charged with Governance.as amended, by the Auditing Standards Boardadopted in a rule of the American Institute of Certified Public Accountants.Company Accounting Oversight Board (“PCAOB”). We have received and reviewed the written disclosures and the letter from the independent auditors required by Independence Standard No. 1,Independence Discussionsapplicable requirements of the PCAOB regarding the independent auditors’ communications with the Audit Committees,as amended, by the Independence Standards Board,Committee concerning independence and have discussed with the auditors the auditors’ independence.

Based on the reviews and discussions referred to above, we recommendrecommended to the Board of Directors that the audited financial statements referred to above be included in the Company’s Annual Report on Form 10-KSB10-K for the year ended December 31, 20072010 and filed with the Securities and Exchange Commission.

The Audit Committee is composed of the three directors named below, all of whom are independent directors as defined in Rule 4200(a)(15) of the NASDAQ Stock Market listing standards.

The Board has adopted a written charter for the Audit Committee.

Submitted by the members of the Audit Committee of the Board of Directors.

Gerald J. Laber, Chairman

Carl A. Bellini

Dennis H. Field

The preceding information under the caption “Report of the Audit Committee” shall be deemed to be “furnished” but not “filed” with the Securities and Exchange Commission.

22SEC.

The following is a description of the fees billed to the Company by its independent auditor (Ehrhardt Keefe Steiner & Hottman PC) for each of the years ended December 31, 20072010 and 2006.

| Audit and Non-Audit Fees | 2007 | 2006 | ||||||

| Audit fees | $ | 97,449 | $ | 85,916 | ||||

| Audit-related fees | 16,839 | 10,965 | ||||||

| Tax fees | 2,208 | 2,022 | ||||||

| All other fees | — | — | ||||||

Total | $ | 116,496 | $ | 98,903 | ||||

| Audit and Non-Audit Fees | 2010 | 2009 | ||||||

Audit fees | $ | 60,693 | $ | 60,184 | ||||

Audit-related fees | 1,185 | 1,185 | ||||||

Tax fees | 2,523 | 2,500 | ||||||

All other fees | — | — | ||||||

Total | $ | 64,401 | $ | 63,869 | ||||

Audit fees are for the audit of the Company’s annual financial statements and the review of the Company’s Annual Report on Form 10-KSB.10-K and the quarterly reviews of the financial statements included in the quarterly reports on form 10-Q. Audit-related fees include required review of certain filings with the SEC, issuance of consents, review of correspondence between the Company and the SEC and services concerning internal controls.controls and transactions. Tax fees primarily include tax compliance, tax advice, including the review of, and assistance in the preparation of, federal and state tax returns.

Policy on Pre-Approval of Audit and Non-Audit Services

The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by the independent public accountants. Pre-approval is generally provided for up to one year, and any pre-approval is detailed as to the particular service or category of services. The Audit Committee has delegated limited pre-approval authority to its chairperson. The chairperson is required to report any decisions to pre-approve such services to the full Audit Committee at its next meeting.

Shareholder proposals for inclusion in the Company’s proxy materials relating to the next annual meeting of shareholders must be received by the Company on or before December 2, 2008.24, 2011. Also, persons named in the proxy solicited by the Board of Directors of the Company for its year 20092011 annual meeting of shareholders may exercise discretionary authority on any proposal presented by a shareholder of the Company at that meeting if the Company has not received notice of the proposal by February 15, 2009.

Shareholders who wish to obtain, without charge, a copy of the Company’s Annual Report on Form 10-KSB report10-K for the year ended December 31, 20072010 in the form filed with the Securities and Exchange CommissionSEC should address a written request to Dennis P. Passantino, Corporate Secretary, Scott’s Liquid Gold-Inc., 4880 Havana Street, Denver, Colorado 80239. The Company’s annual report to shareholders consists of such Form 10-KSB and accompanies this proxy statement.

23

The Company will pay the cost of soliciting proxies in the accompanying form. In addition to solicitation by mail, proxies may be solicited by officers and other regular employees of the Company by telephone, telegraph or by personal interview for which employees will not receive additional compensation. Arrangements also may be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of the shares held of record by such

persons, and the Company may reimburse such persons for reasonable out-of pocket expenses incurred by them in so doing.

As of the date of this Proxy Statement, Managementmanagement was not aware that any business not described above would be presented for consideration at the meeting. If any other business properly comes before the meeting, it is intended that the shares represented by proxies will be voted in respect thereto in accordance with the judgment of the persons voting them.

The above Notice and Proxy Statement are sent by order of the Board of Directors.

24

25

/s/ Jeffrey R. Hinkle | ||

Jeffrey R. Hinkle Corporate Secretary |

26

April 20, 2011

27

28

| ||||

2005 Stock Incentive Plan

| 1.1 | Award | 1 | ||||

| 1.2 | Board of Directors | 1 | ||||

| 1.3 | Cause | 1 | ||||

| 1.4 | Change in Control | 1 | ||||

| 1.5 | Code | 2 | ||||

| 1.6 | Common Stock or Stock | 2 | ||||

| 1.7 | Consultant | 2 | ||||

| 1.8 | Continuous Service | 2 | ||||

| 1.9 | Director | 3 | ||||

| 1.10 | Disability | 3 | ||||

| 1.11 | Effective Date | 3 | ||||

| 1.12 | Employee | 3 | ||||

| 1.13 | Exchange Act | 3 | ||||

| 1.14 | Fair Market Value | 3 | ||||

| 1.15 | Incentive Stock Option | 3 | ||||

| 1.16 | Nonqualified Stock Option | 3 | ||||

| 1.17 | Option | 3 | ||||

| 1.18 | Option Agreement | 3 | ||||

| 1.19 | Parent | 3 | ||||

| 1.20 | Participant | 4 | ||||

| 1.21 | Plan Administrator | 4 | ||||

| 1.22 | Repriced | 4 | ||||

| 1.23 | Restricted Stock | 4 | ||||

| 1.24 | Restricted Stock Award Agreement | 4 | ||||

| 1.25 | Restricted Stock Unit or RSU | 4 | ||||

| 1.26 | Restricted Stock Unit Award Agreement | 4 | ||||

| 1.27 | Restriction Period | 4 | ||||

| 1.28 | Rule 16b-3 | 4 | ||||

| 1.29 | Stock Appreciation Right or SAR | 4 | ||||

| 1.30 | Stock Appreciation Right Award Agreement | 4 | ||||

| 1.31 | Subsidiary | 4 | ||||

| 1.32 | Termination Date | 5 |

| 3.1 | Plan Administrator | 5 | ||||

| 3.2 | Meetings and Actions | 5 |

| 3.3 | Powers of Plan Administrator | 5 | ||||

| 3.4 | Interpretation of Plan | 5 |

| 4.1 | Plan Limit | 6 | ||||

| 4.2 | Individual Limit | 6 | ||||

| 4.3 | Unused Stock | 6 | ||||

| 4.4 | Adjustment for Change in Outstanding Shares | 6 | ||||

| 4.5 | Retention of Rights | 7 | ||||

| 4.6 | Cancellation of Award | 7 |

| 6.1 | Grant of Options | 8 | ||||

| 6.2 | Option Agreement | 8 | ||||

| 6.3 | Manner of Exercise | 9 | ||||

| 6.4 | Payment of Option Price | 9 |

| 7.1 | Grant of SARs | 10 | ||||

| 7.2 | Award Agreement | 10 | ||||

| 7.3 | Manner of Exercise | 10 |

| 8.1 | Grant of Restricted Stock and Restricted Stock Units | 11 | ||||

| 8.2 | Award Agreement | 11 |

| 9.1 | Termination of Continuous Service for Options and SARs | 13 | ||||

| 9.2 | Termination of Continuous Service for Restricted Stock and RSUs | 14 |

| 10.1 | Substitution of Awards | 14 | ||||

| 10.2 | Acceleration of Vesting | 14 |

| 11.1 | Transfer of Shares to Participant | 15 |

| 11.2 | Legend | 15 | ||||

| 11.3 | Compliance with Laws | 15 | ||||

| 11.4 | Investment Representation | 16 |

| 12.1 | Amendment of the Plan | 16 | ||||

| 12.2 | Termination of the Plan | 16 |

| 13.1 | Tax Obligations | 17 | ||||

| 13.2 | No Employment Rights | 17 | ||||

| 13.3 | Nontransferability of Awards | 17 | ||||

| 13.4 | Participants in Foreign Countries | 18 | ||||

| 13.5 | Other Employee Benefits | 18 | ||||

| 13.6 | Confidentiality of Information | 18 | ||||

| 13.7 | Severability | 18 | ||||

| 13.8 | Governing Law and Venue | 18 | ||||

| 13.9 | Use of Proceeds | 18 |

2. Amendment of Plan. The following amendment to the Plan is to further the growth and development of Scott’s Liquid Gold-Inc., a Colorado corporation (the “Company”), by affording an opportunity for stock ownership to selected Employees, Directors and Consultants of the Company and its Subsidiaries who are responsible for the conduct and management of its business or who are involvedadopted, effective as provided in endeavors significant to its success. Paragraph 3 below:

The Plan is also intendedhereby amended to assistrevise the Company in attracting new Employees and Consultants and retaining existing Employees and Consultants; to encourage growthfirst sentence of Section 4.1 of the Company through incentives that are consistent with the Company’s goals;Plan to provide incentives for individual performance; and to promote teamwork.

2

3

4

| 4.1 | ||

5

| Plan Limit. Subject to the provisions of Section 4.4, the aggregate number of shares of Common Stock that may be issued under Awards granted pursuant to the Plan shall not exceed |

3. Effective Date. The Effective Date of this Amendment shall be the date on which the shareholders approve this amendment.

4. Terms and Conditions of Plan. Except for the amendment in paragraph 2, all terms and conditions of the Plan are unamended and shall remain in full force and effect.

5. Execution. Scott’s Liquid Gold-Inc. has executed this Amendment as of the date set forth below.

SCOTT’S LIQUID GOLD-INC. COMPANY | ||

By: | ||

6

COMPENSATION COMMITTEE CHARTER

COMPENSATION COMMITTEE RESOLUTION

April 2011

RESOLVED, that the members of the Compensation Committee shall consist of at least two or more outside Directors of the Company as determined by the Board of Directors from time to time;

RESOLVED, that the Compensation Committee of the Board of Directors shall have the following authority and responsibilities:

1. To review the development of an executive compensation philosophy for the Company; and to obtain all relevant data and information to perform its functions, including the retention of outside consultants at the Company’s expense, if necessary;

2. To review all executive compensation proposals, including recommendations as to salaries, bonuses, determinations of stock grants under various stock plans and other executive benefits and perquisites;

3. To review the duties and responsibilities of the executive officers over time; and to recommend adjustments to compensation of executive officers up or down as appropriate;

4. To review the appropriate mix of variable versus fixed compensation for the Company’s executives and to make recommendations on this issue, as appropriate; and

5. To review the Company’s bonus and other long-term incentive plans and to determine if procedures followed historically are the most effective.

SCOTT’S LIQUID GOLD-INC. 4880 HAVANA ST.

DENVER, CO 8023 ATTN: SHELLEY KENNISON

1 | |||

Investor Address Line 1 Investor Address Line 2 Investor Address Line 3 1 1 OF Investor Address Line 4 Investor Address Line 5 John Sample 1234 ANYWHERE STREET 2 ANY CITY, ON A1A 1A1

NAME

THE COMPANY NAME INC.—COMMON THE COMPANY NAME INC.—CLASS A THE COMPANY NAME INC.—CLASS B THE COMPANY NAME INC.—CLASS C THE COMPANY NAME INC.—CLASS D THE COMPANY NAME INC.—CLASS E THE COMPANY NAME INC.—CLASS F THE COMPANY NAME INC.—401 K

x

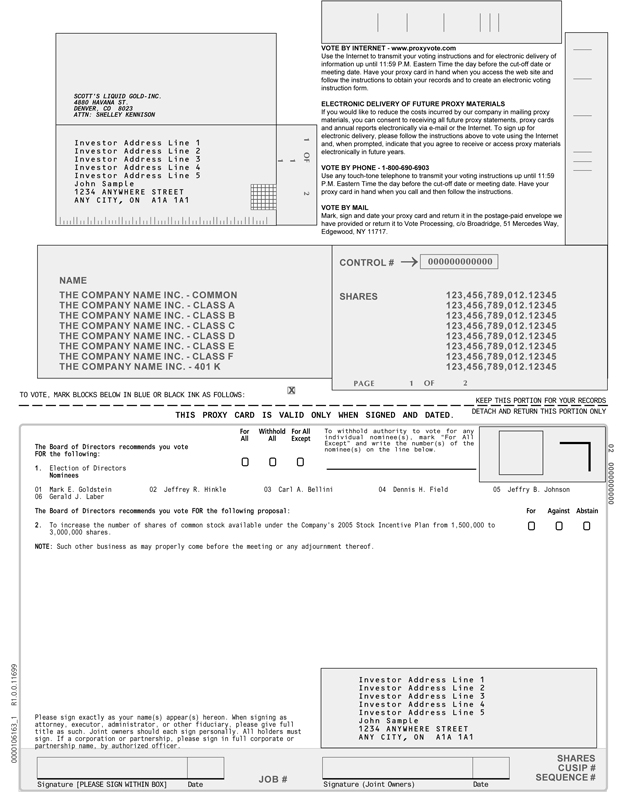

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS:

VOTE BY INTERNET—www.proxyvote.com

Use the Internet to transmit your voting instructions and part-time Employees shall be eligiblefor electronic delivery of information up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form.

ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years.

VOTE BY PHONE—1-800-690-6903

Use any Awardtouch-tone telephone to transmit your voting instructions up until 11:59 P.M. Eastern Time the day before the cut-off date or meeting date. Have your proxy card in hand when you call and then follow the instructions.

VOTE BY MAIL

Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

CONTROL # 000000000000

SHARES 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345 123,456,789,012.12345

PAGE 1 OF 2

KEEP THIS PORTION FOR YOUR RECORDS

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

DETACH AND RETURN THIS PORTION ONLY

For Withhold For All

To withhold authority to vote for any

All

All

Except

individual nominee(s), mark “For All

Except” and write the number(s) of the

The Board of Directors recommends you vote

nominee(s) on

the line below.

02

FOR the following:

0

0

0

1. Election of Directors

Nominees

01 Mark E. Goldstein 02 Jeffrey R. Hinkle 03 Carl A. Bellini 04 Dennis H. Field 05 Jeffry B. Johnson

06 Gerald J. Laber 0000000000

The Board of Directors recommends you vote FOR the following proposal:

For

Against

Abstain

2. To increase the number of shares of common stock available under the Plan. Directors and Consultants who are not Employees shall be eligibleCompany’s 2005 Stock Incentive Plan from 1,500,000 to receive

0

0

0 3,000,000 shares.

NOTE: Such other business as may properly come before the meeting or any Award,adjournment thereof.

Investor Address Line 1 Investor Address Line 2 R1.0.0.11699

Investor Address Line

3

Investor Address Line

4

Investor Address Line

5

1 Please sign exactly as your name(s) appear(s) hereon. When signing as

_

John Sample

attorney, executor, administrator, or other than Incentive Stock Options, under the Plan. Any Director who is otherwise eligible to participate, who makes an electionfiduciary, please give fulltitle as such. Joint owners should each sign personally. All holders must

1234 ANYWHERE

STREET

sign. If a corporation or partnership, please sign in writing not to receive any grants under the Plan, shall not be eligible to receive any such grants during the period set forth in such election.

7ANY CITY, ON

A1A 1A1

partnership name, by authorized officer.

0000106163

SHARES

CUSIP #

JOB #

SEQUENCE #

Signature [PLEASE SIGN WITHIN BOX]

Date

Signature (Joint Owners)

Date

8

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice & Proxy Statement, Annual Report is/are available at www.proxyvote.com .

9

Annual Meeting of ShareholdersMay 18, 2011 9:00 AM

10

This proxy is solicited by the Board of Directors for use at the Annual Meeting on May 18, 2011, at 9:00 A.M. Mountain Time, or anyadjournment thereof.

11

If no choice is specified, the proxy will be voted “FOR” Item 1 and Item 2.By signing the proxy, you revoke all prior proxies and appoint Mark E. Goldstein, and Jeffrey R. Hinkle and each of them acting in the

12

any other matters which may come before the Annual Meeting and all adjournmentsContinued and to be signed on reverse side

13

14

15

16

17

18